top of page

Connecticut Housing Market Update: Why 2026 Feels Different for Buyers and Sellers

January 22, 2026 | Market Update | Presented by ReadySetLoan™️ A Market in Transition, Not Turmoil After several years of fast-moving conditions and aggressive competition, the housing market is finally showing signs of balance. Heading into 2026, buyers and sellers in Connecticut are navigating a landscape that feels noticeably different — not crashing, not surging, but recalibrating. At ReadySetLoan™️, we see this moment as an important reset: more inventory, more thoughtfu

Neil Caron

Jan 223 min read

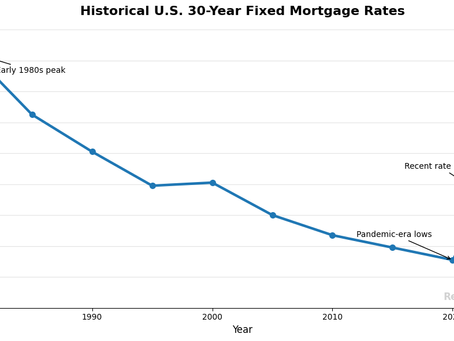

Are Mortgage Rates High Right Now? What Connecticut Homebuyers Can Learn From History

January 1st 2026 | Market Insights | Presented by ReadySetLoan™ Mortgage rates have been one of the biggest concerns for Connecticut homebuyers over the past two years. With rates no longer sitting at historic lows, many buyers are asking the same question: Are mortgage rates actually high — or just high compared to what we recently experienced? Looking at mortgage rate history provides important perspective, especially for buyers navigating today’s Connecticut housing market

Neil Caron

Jan 12 min read

Housing Affordability in 2026: Why Connecticut Buyers May Finally Catch a Break

December 18, 2025 | Connecticut Housing Market | Presented by ReadySetLoan™️ For Connecticut homebuyers, the last few years have felt like chasing a finish line that keeps moving. Prices jumped, rates rose, and inventory stayed painfully tight — especially in towns like South Windsor, West Hartford, Glastonbury, Mystic, and along the shoreline. As we look ahead to 2026, the affordability picture in Connecticut is starting to change — not with a crash or dramatic reset, but

Neil Caron

Dec 18, 20254 min read

A Fairer Score: Fannie Mae’s Credit Update Could Help Millions Qualify for Mortgages

November 15th, 2025 | Market Insights | Presented by ReadySetLoan™️ Big news for homebuyers — especially those just starting their credit journey. Fannie Mae has announced a major update to its credit score requirements that could help more Americans qualify for mortgages. By expanding the models it uses and recognizing alternative credit data like rent and utility payments, Fannie Mae aims to make the mortgage process more inclusive while maintaining responsible lending stan

Neil Caron

Nov 15, 20253 min read

Still Frozen: Why Home Sales Aren’t Heating Up Yet

November 14th, 2025 | Market Insights | Presented by ReadySetLoan™️ The U.S. housing market has been stuck in a deep freeze — with high mortgage rates, affordability pressure, and sellers reluctant to let go of low-rate homes. While there are signs of softening (more listings, slightly better sentiment), the thaw is slow and incomplete. Buyers are cautious, sellers remain hesitant, and the rebound hasn’t gained enough heat yet. What’s really keeping the market frozen Even wit

Neil Caron

Nov 14, 20252 min read

“Odds Slide: Fed May Be Less Eager to Cut Rates Again”

November 13th, 2025 | Market Insights | Presented by ReadySetLoan™️ Markets were brimming with optimism that the Fed would cut short-term rates in December. Just a week ago, that probability was as high as ~91%. Now, those odds have dropped to around ~70% as inflation remains stubborn and internal dissent grows. This change is sending ripples through mortgage markets and borrower expectations. Why the optimism is cooling Even though there was a recent rate cut, some Fed offic

Neil Caron

Nov 13, 20252 min read

Surge of New Yorkers? What It Means for Connecticut Housing

November 12, 2025 | Market Insights | Presented by ReadySetLoan™️ The recent election outcome in New York City has stirred talk of residents reconsidering their living arrangements. With the new city leadership and shifting policies, some New Yorkers are exploring suburban or nearby states — and Connecticut is firmly in the conversation. While the exodus may not be massive, the ripple effects could impact the housing and mortgage landscape for local buyers and homeowners. The

Neil Caron

Nov 12, 20253 min read

Homeowners Remain Financially Strong — No Foreclosure Storm in Sight

November 11th, 2025 | Market Insights | Presented by ReadySetLoan™️ Despite concerns of rising financial strain, the latest data from Federal Reserve Bank of New York shows that U.S. homeowners are overall in solid shape — with strong equity, good credit, and low risk of foreclosure. While some parts of the market may be bumping along, this isn’t the crisis many feared. For homeowners and buyers in Connecticut, this is welcome news — but also a reminder to stay prepared and p

Neil Caron

Nov 11, 20253 min read

When the Fed Cuts, But Your Rate Doesn’t: The Mortgage Myth Unpacked

November 10, 2025 | Market Insights | Presented by ReadySetLoan™️ The headlines say it loud and clear: “The Fed Just Cut Rates!” — and naturally, homebuyers across Connecticut start asking the same question: “Does that mean my mortgage rate is going down?” Not so fast. While a Fed rate cut may sound like a silver bullet for borrowers, the truth is far more complex. The Federal Reserve influences the economy in many ways — but long-term mortgage rates don’t always follow its

Neil Caron

Nov 10, 20253 min read

Demand Cools as Rates Rebound: What This Means for Connecticut Buyers

November 9, 2025 | Market Insights | Presented by ReadySetLoan™️ Mortgage demand is slowing again, even after rates dipped to their lowest point of the year. That brief moment of relief sparked some activity — but as rates crept back up, buyer enthusiasm cooled fast. For Connecticut homebuyers and homeowners, this is a real-time reminder that the mortgage market moves faster than the headlines — and that being prepared is far more valuable than waiting for the perfect moment.

Neil Caron

Nov 9, 20253 min read

The End of the Penny: Rounding Up to a New Reality

November 8, 2025 | Industry Insights | Presented by ReadySetLoan™️ America’s smallest coin is finally being phased out — and the ripple effects are larger than you’d think. As the U.S. Mint halts penny production, businesses from Burger King to local coffee shops are bracing for a world where transactions no longer end in “.99.” While it may sound trivial, this shift in how we handle small change carries big lessons about adaptation, efficiency, and value. Small Change, Big C

Neil Caron

Nov 8, 20252 min read

Deals Falling Through: Buyer Caution Rises in a Shaky Economy

November 6th, 2025 | Market Insights | Presented by ReadySetLoan™️ More home-purchase deals are collapsing before closing as economic uncertainty grows. Nationwide, roughly 15% of pending home sales were canceled in September , up from 13.6% a year earlier. Buyers are increasingly pulling out due to job worries, tighter budgets, and shifting confidence. For Connecticut, where affordability is already stretched, this trend highlights the importance of preparation, strategy, an

Neil Caron

Nov 6, 20252 min read

☀️ Summer Surge or Sputter? Will Rising Inventory Cool Down New England’s Red-Hot Housing Season?

August 12, 2025 | Market Trends & Inventory | Presented by ReadySetLoan™️ New England’s summer real estate market has long been a...

Neil Caron

Aug 12, 20252 min read

🚗 Trouble in the Fast Lane: 3 Car Brands That Could Stall Out in 2025

August 11, 2025 | Auto Trends & Economics | Presented by ReadySetLoan™️ In a market that’s no stranger to shakeups, 2025 may be a speed...

Neil Caron

Aug 11, 20252 min read

📊 Who's Calling the Shots? The Fed's New Voting Bloc Could Shape Your Mortgage Rate

August 8, 2025 | Mortgage Market Trends | Presented by ReadySetLoan™ When it comes to mortgage rates, the Federal Reserve’s decisions are...

Neil Caron

Aug 8, 20252 min read

📍Foreclosures on the Rise: What Connecticut Homeowners Need to Know Now

August 1, 2025 | Market Watch | Presented by ReadySetLoan™ The first half of 2025 brought an unwelcome milestone: foreclosure filings...

Neil Caron

Aug 1, 20252 min read

Financing the Future: Tiny Homes, Big Potential

July 29, 2025 | Housing Innovation | Presented by ReadySetLoan™ Backyards are getting an upgrade — and ReadySetLoan™ is here to help you...

Neil Caron

Jul 29, 20252 min read

Crypto & Mortgages: Can Your Bitcoin Buy You a Home?

July 27, 2025 | Market Insights | Presented by ReadySetLoan™ The dream of buying a home with cryptocurrency might sound like a scene from...

Neil Caron

Jul 27, 20252 min read

🧾 The “Big Beautiful Bill” Just Landed – What It Means for Connecticut Real Estate

July 25, 2025 | Policy & Market Updates | Presented by ReadySetLoan™ Washington just dropped a legislative bombshell that could reshape...

Neil Caron

Jul 25, 20252 min read

Good News for Buyers: Fannie Mae & Freddie Mac Step Up to Prevent Foreclosures

July 7, 2025 | Homebuyer Opportunities | Presented by ReadySetLoan™ At ReadySetLoan™ , we’re always looking for silver linings and...

Neil Caron

Jul 7, 20252 min read

bottom of page