top of page

All Posts

Connecticut Housing Market Update: Why 2026 Feels Different for Buyers and Sellers

January 22, 2026 | Market Update | Presented by ReadySetLoan™️ A Market in Transition, Not Turmoil After several years of fast-moving conditions and aggressive competition, the housing market is finally showing signs of balance. Heading into 2026, buyers and sellers in Connecticut are navigating a landscape that feels noticeably different — not crashing, not surging, but recalibrating. At ReadySetLoan™️, we see this moment as an important reset: more inventory, more thoughtfu

Neil Caron

Jan 223 min read

Connecticut Home Sales Rise in 2025: What CT Homebuyers Need to Know for 2026

January 13, 2026 | Connecticut Housing Market Update | Presented by ReadySetLoan™ The Connecticut housing market ended 2025 with steady momentum. Home sales increased modestly, prices remained elevated, and inventory stayed tight — conditions that continue to shape the experience for Connecticut homebuyers heading into 2026. For buyers navigating today’s market, one reality stands out: flexibility matters . That includes not only where you buy, but what kind of home you’re

Neil Caron

Jan 133 min read

Could a Ban on Large Investors Help Connecticut Homebuyers?

January 2026 | Housing Market | Presented by ReadySetLoan™️ Over the past few years, many Connecticut homebuyers—especially first-time buyers—have felt like they’re competing against more than just other families. Large investors, private equity firms, and real estate investment trusts have increasingly entered the single-family housing market, often buying homes in bulk and turning them into long-term rentals. A new proposal from former President Donald Trump aims to change

Neil Caron

Jan 82 min read

Could Mortgage Portability Unlock Connecticut’s Housing Market?

January 2026 | Connecticut Housing Insight | Presented by ReadySetLoan™️ Connecticut homeowners are sitting on something incredibly valuable right now: historically low mortgage rates locked in over the past few years. The problem is those same low rates are keeping many people stuck. A growing concept known as mortgage portability could offer a smarter path forward, especially for Connecticut buyers looking to move without giving up the financing they worked hard to secure.

Neil Caron

Jan 73 min read

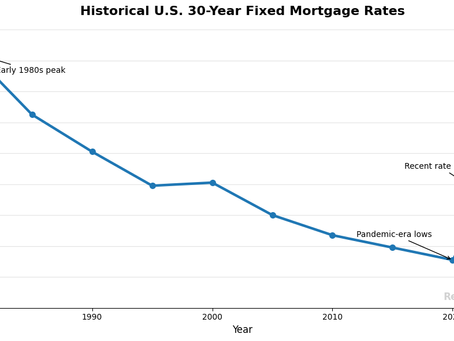

Are Mortgage Rates High Right Now? What Connecticut Homebuyers Can Learn From History

January 1st 2026 | Market Insights | Presented by ReadySetLoan™ Mortgage rates have been one of the biggest concerns for Connecticut homebuyers over the past two years. With rates no longer sitting at historic lows, many buyers are asking the same question: Are mortgage rates actually high — or just high compared to what we recently experienced? Looking at mortgage rate history provides important perspective, especially for buyers navigating today’s Connecticut housing market

Neil Caron

Jan 12 min read

Is an All-In-One Loan Right for Connecticut Homeowners?

January 31, 2026 | Connecticut Mortgage Education | Presented by ReadySetLoan™️ For many Connecticut homeowners, the biggest financial question isn’t whether they can afford their home — it’s how to manage their mortgage more efficiently over time. With higher home prices across Hartford County, Tolland County, New London County, and shoreline communities like Mystic and Stonington, buyers are increasingly focused on interest management, cash flow, and long-term equity str

Neil Caron

Dec 31, 20253 min read

I’m 18, I’m in College… How Do I Even Start Preparing to Buy a Home Someday?

December 2025 | First-Time Homebuyers | Presented by ReadySetLoan™️ Hi. I’m 18 years old. I’m in college. I don’t own a house. I don’t even own a couch that wasn’t free. But I do think about the future — and one of the biggest questions I keep asking is: How does someone my age actually get ready to buy a home in Connecticut someday? Everyone keeps talking about down payments , mortgage programs , and credit , but no one really explains it in a way that makes sense if you’r

Neil Caron

Dec 30, 20253 min read

Housing Affordability in 2026: Why Connecticut Buyers May Finally Catch a Break

December 18, 2025 | Connecticut Housing Market | Presented by ReadySetLoan™️ For Connecticut homebuyers, the last few years have felt like chasing a finish line that keeps moving. Prices jumped, rates rose, and inventory stayed painfully tight — especially in towns like South Windsor, West Hartford, Glastonbury, Mystic, and along the shoreline. As we look ahead to 2026, the affordability picture in Connecticut is starting to change — not with a crash or dramatic reset, but

Neil Caron

Dec 18, 20254 min read

Can I Qualify for a CHFA Mortgage? A Connecticut Buyer’s Guide From 25+ Years in the Trenches

If you’ve ever wondered whether you can qualify for a CHFA mortgage , you’re not alone. After 25+ years of originating these loans for thousands of Connecticut buyers, I can tell you that most people either underestimate their eligibility or have been told incorrect information . CHFA is absolutely one of the strongest, most flexible first-time homebuyer programs in the country — but most buyers don’t understand how qualification really works. Here’s a clear, experience-drive

Neil Caron

Dec 7, 20254 min read

How Connecticut’s Pizza Pride Became a National Power Move

December 3, 2025 | Connecticut Lifestyle | Presented by ReadySetLoan™️ Connecticut just pulled off one of the cleverest branding wins of the year: a statewide campaign staking its claim as the pizza capital of the United States . And believe it or not, that marketing push is reshaping how people across the country see our little corner of New England. It’s bold, it’s fun — and, honestly, it says a lot about how Connecticut is leaning into identity, culture, and community in a

Neil Caron

Dec 3, 20252 min read

A History of Conforming Loan Limits

December 2025 | Mortgage Basics | Presented by ReadySetLoan™️ Conforming loan limits shape how much buyers can borrow while staying within traditional Fannie Mae and Freddie Mac guidelines. These limits shift over time as home prices rise, and understanding how they’ve changed helps buyers, sellers, investors, and homeowners make smart decisions. Here’s a clear, ReadySetLoan™️-style breakdown of how conforming loan limits have evolved — and why the numbers keep moving upward.

Neil Caron

Dec 1, 20253 min read

A Fairer Score: Fannie Mae’s Credit Update Could Help Millions Qualify for Mortgages

November 15th, 2025 | Market Insights | Presented by ReadySetLoan™️ Big news for homebuyers — especially those just starting their credit journey. Fannie Mae has announced a major update to its credit score requirements that could help more Americans qualify for mortgages. By expanding the models it uses and recognizing alternative credit data like rent and utility payments, Fannie Mae aims to make the mortgage process more inclusive while maintaining responsible lending stan

Neil Caron

Nov 15, 20253 min read

Still Frozen: Why Home Sales Aren’t Heating Up Yet

November 14th, 2025 | Market Insights | Presented by ReadySetLoan™️ The U.S. housing market has been stuck in a deep freeze — with high mortgage rates, affordability pressure, and sellers reluctant to let go of low-rate homes. While there are signs of softening (more listings, slightly better sentiment), the thaw is slow and incomplete. Buyers are cautious, sellers remain hesitant, and the rebound hasn’t gained enough heat yet. What’s really keeping the market frozen Even wit

Neil Caron

Nov 14, 20252 min read

“Odds Slide: Fed May Be Less Eager to Cut Rates Again”

November 13th, 2025 | Market Insights | Presented by ReadySetLoan™️ Markets were brimming with optimism that the Fed would cut short-term rates in December. Just a week ago, that probability was as high as ~91%. Now, those odds have dropped to around ~70% as inflation remains stubborn and internal dissent grows. This change is sending ripples through mortgage markets and borrower expectations. Why the optimism is cooling Even though there was a recent rate cut, some Fed offic

Neil Caron

Nov 13, 20252 min read

Is a 50-Year Mortgage the Right Move? What Every Connecticut Homebuyer Should Know

November 12, 2025 | Mortgage Strategy | Presented by ReadySetLoan™️ The 50-year mortgage has entered the conversation as buyers search for creative ways to make homeownership more affordable. But before you sign up for half a century of payments, it’s important to understand how stretching your term impacts your total cost, equity growth, and financial flexibility. Why the 50-Year Mortgage Is Gaining Attention As home prices and mortgage rates remain elevated, some lenders ha

Neil Caron

Nov 12, 20252 min read

Surge of New Yorkers? What It Means for Connecticut Housing

November 12, 2025 | Market Insights | Presented by ReadySetLoan™️ The recent election outcome in New York City has stirred talk of residents reconsidering their living arrangements. With the new city leadership and shifting policies, some New Yorkers are exploring suburban or nearby states — and Connecticut is firmly in the conversation. While the exodus may not be massive, the ripple effects could impact the housing and mortgage landscape for local buyers and homeowners. The

Neil Caron

Nov 12, 20253 min read

Homeowners Remain Financially Strong — No Foreclosure Storm in Sight

November 11th, 2025 | Market Insights | Presented by ReadySetLoan™️ Despite concerns of rising financial strain, the latest data from Federal Reserve Bank of New York shows that U.S. homeowners are overall in solid shape — with strong equity, good credit, and low risk of foreclosure. While some parts of the market may be bumping along, this isn’t the crisis many feared. For homeowners and buyers in Connecticut, this is welcome news — but also a reminder to stay prepared and p

Neil Caron

Nov 11, 20253 min read

When the Fed Cuts, But Your Rate Doesn’t: The Mortgage Myth Unpacked

November 10, 2025 | Market Insights | Presented by ReadySetLoan™️ The headlines say it loud and clear: “The Fed Just Cut Rates!” — and naturally, homebuyers across Connecticut start asking the same question: “Does that mean my mortgage rate is going down?” Not so fast. While a Fed rate cut may sound like a silver bullet for borrowers, the truth is far more complex. The Federal Reserve influences the economy in many ways — but long-term mortgage rates don’t always follow its

Neil Caron

Nov 10, 20253 min read

Demand Cools as Rates Rebound: What This Means for Connecticut Buyers

November 9, 2025 | Market Insights | Presented by ReadySetLoan™️ Mortgage demand is slowing again, even after rates dipped to their lowest point of the year. That brief moment of relief sparked some activity — but as rates crept back up, buyer enthusiasm cooled fast. For Connecticut homebuyers and homeowners, this is a real-time reminder that the mortgage market moves faster than the headlines — and that being prepared is far more valuable than waiting for the perfect moment.

Neil Caron

Nov 9, 20253 min read

The End of the Penny: Rounding Up to a New Reality

November 8, 2025 | Industry Insights | Presented by ReadySetLoan™️ America’s smallest coin is finally being phased out — and the ripple effects are larger than you’d think. As the U.S. Mint halts penny production, businesses from Burger King to local coffee shops are bracing for a world where transactions no longer end in “.99.” While it may sound trivial, this shift in how we handle small change carries big lessons about adaptation, efficiency, and value. Small Change, Big C

Neil Caron

Nov 8, 20252 min read

bottom of page