top of page

Mortgage Market Insights

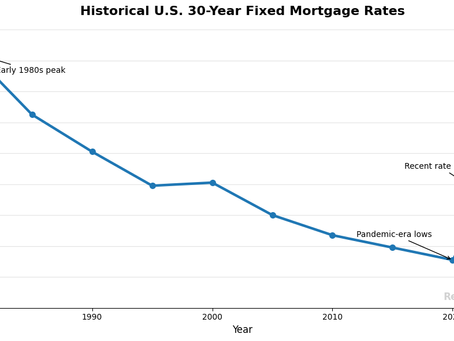

Are Mortgage Rates High Right Now? What Connecticut Homebuyers Can Learn From History

January 1st 2026 | Market Insights | Presented by ReadySetLoan™ Mortgage rates have been one of the biggest concerns for Connecticut homebuyers over the past two years. With rates no longer sitting at historic lows, many buyers are asking the same question: Are mortgage rates actually high — or just high compared to what we recently experienced? Looking at mortgage rate history provides important perspective, especially for buyers navigating today’s Connecticut housing market

Neil Caron

Jan 12 min read

A History of Conforming Loan Limits

December 2025 | Mortgage Basics | Presented by ReadySetLoan™️ Conforming loan limits shape how much buyers can borrow while staying within traditional Fannie Mae and Freddie Mac guidelines. These limits shift over time as home prices rise, and understanding how they’ve changed helps buyers, sellers, investors, and homeowners make smart decisions. Here’s a clear, ReadySetLoan™️-style breakdown of how conforming loan limits have evolved — and why the numbers keep moving upward.

Neil Caron

Dec 1, 20253 min read

A Fairer Score: Fannie Mae’s Credit Update Could Help Millions Qualify for Mortgages

November 15th, 2025 | Market Insights | Presented by ReadySetLoan™️ Big news for homebuyers — especially those just starting their credit journey. Fannie Mae has announced a major update to its credit score requirements that could help more Americans qualify for mortgages. By expanding the models it uses and recognizing alternative credit data like rent and utility payments, Fannie Mae aims to make the mortgage process more inclusive while maintaining responsible lending stan

Neil Caron

Nov 15, 20253 min read

Still Frozen: Why Home Sales Aren’t Heating Up Yet

November 14th, 2025 | Market Insights | Presented by ReadySetLoan™️ The U.S. housing market has been stuck in a deep freeze — with high mortgage rates, affordability pressure, and sellers reluctant to let go of low-rate homes. While there are signs of softening (more listings, slightly better sentiment), the thaw is slow and incomplete. Buyers are cautious, sellers remain hesitant, and the rebound hasn’t gained enough heat yet. What’s really keeping the market frozen Even wit

Neil Caron

Nov 14, 20252 min read

“Odds Slide: Fed May Be Less Eager to Cut Rates Again”

November 13th, 2025 | Market Insights | Presented by ReadySetLoan™️ Markets were brimming with optimism that the Fed would cut short-term rates in December. Just a week ago, that probability was as high as ~91%. Now, those odds have dropped to around ~70% as inflation remains stubborn and internal dissent grows. This change is sending ripples through mortgage markets and borrower expectations. Why the optimism is cooling Even though there was a recent rate cut, some Fed offic

Neil Caron

Nov 13, 20252 min read

Is a 50-Year Mortgage the Right Move? What Every Connecticut Homebuyer Should Know

November 12, 2025 | Mortgage Strategy | Presented by ReadySetLoan™️ The 50-year mortgage has entered the conversation as buyers search for creative ways to make homeownership more affordable. But before you sign up for half a century of payments, it’s important to understand how stretching your term impacts your total cost, equity growth, and financial flexibility. Why the 50-Year Mortgage Is Gaining Attention As home prices and mortgage rates remain elevated, some lenders ha

Neil Caron

Nov 12, 20252 min read

Homeowners Remain Financially Strong — No Foreclosure Storm in Sight

November 11th, 2025 | Market Insights | Presented by ReadySetLoan™️ Despite concerns of rising financial strain, the latest data from Federal Reserve Bank of New York shows that U.S. homeowners are overall in solid shape — with strong equity, good credit, and low risk of foreclosure. While some parts of the market may be bumping along, this isn’t the crisis many feared. For homeowners and buyers in Connecticut, this is welcome news — but also a reminder to stay prepared and p

Neil Caron

Nov 11, 20253 min read

When the Fed Cuts, But Your Rate Doesn’t: The Mortgage Myth Unpacked

November 10, 2025 | Market Insights | Presented by ReadySetLoan™️ The headlines say it loud and clear: “The Fed Just Cut Rates!” — and naturally, homebuyers across Connecticut start asking the same question: “Does that mean my mortgage rate is going down?” Not so fast. While a Fed rate cut may sound like a silver bullet for borrowers, the truth is far more complex. The Federal Reserve influences the economy in many ways — but long-term mortgage rates don’t always follow its

Neil Caron

Nov 10, 20253 min read

Demand Cools as Rates Rebound: What This Means for Connecticut Buyers

November 9, 2025 | Market Insights | Presented by ReadySetLoan™️ Mortgage demand is slowing again, even after rates dipped to their lowest point of the year. That brief moment of relief sparked some activity — but as rates crept back up, buyer enthusiasm cooled fast. For Connecticut homebuyers and homeowners, this is a real-time reminder that the mortgage market moves faster than the headlines — and that being prepared is far more valuable than waiting for the perfect moment.

Neil Caron

Nov 9, 20253 min read

Deals Falling Through: Buyer Caution Rises in a Shaky Economy

November 6th, 2025 | Market Insights | Presented by ReadySetLoan™️ More home-purchase deals are collapsing before closing as economic uncertainty grows. Nationwide, roughly 15% of pending home sales were canceled in September , up from 13.6% a year earlier. Buyers are increasingly pulling out due to job worries, tighter budgets, and shifting confidence. For Connecticut, where affordability is already stretched, this trend highlights the importance of preparation, strategy, an

Neil Caron

Nov 6, 20252 min read

Will 6% Mortgage Rates Unlock New Opportunities for Homebuyers?

November 5, 2025 | Mortgage Insights | Presented by ReadySetLoan™️ Mortgage rates hovering in the low-6% range are breathing some fresh air into an otherwise tight housing market. While affordability is still a challenge, buyers are finally seeing a window of opportunity. The key now is understanding how to make the most of it — from timing your purchase to evaluating loan options and assistance programs that can help turn “maybe someday” into “let’s do this.” 📉 Rates Are Ea

Neil Caron

Nov 5, 20253 min read

Adjustable-Rate Mortgages Are Back: A Hidden Risk in Today’s Market

November 2025 | Mortgage Insights | Presented by ReadySetLoan™️ The Return of a Risky Loan Type As mortgage rates remain elevated, many buyers are turning again to adjustable-rate mortgages (ARMs) to reduce initial costs. These loan products were once at the center of the housing collapse, but are now making a comeback. ARMs offer lower starting rates, typically for a fixed period, before adjusting based on short-term interest rates. For borrowers looking to minimize monthly

Neil Caron

Nov 3, 20252 min read

Hot and Cheap: 7 Markets Where Buyers Can Still Snag Homes Under $300K

September 23, 2025 | Housing Market Insights | Presented by ReadySetLoan™️ For buyers watching prices soar in many parts of the country,...

Neil Caron

Sep 23, 20252 min read

The Next Generation of Buyers: Confident Yet Confused

September 22, 2025 | Housing Market Insights | Presented by ReadySetLoan™️ Key Findings from the NextGen Report A new report reveals a...

Neil Caron

Sep 22, 20252 min read

Is Mortgage Relief Fueling the Next Housing Bubble?

September 15, 2025 | Housing Policy | Presented by ReadySetLoan™️ Despite stubbornly high interest rates, home prices across the U.S. —...

Neil Caron

Sep 15, 20252 min read

🏠 Dream Deferred? Why Two-Thirds of Gen Z Think They’ll Never Own a Home

August 18, 2025 | Gen Z & Housing | Presented by ReadySetLoan™️ In a revealing new survey from Clever Offers, nearly two-thirds of Gen Z...

Neil Caron

Aug 18, 20252 min read

💸 Venmo the National Debt? Yup, That’s Now a Thing (Even for Connecticut Residents)

August 6, 2025 | Mortgage & Money Matters | Presented by ReadySetLoan™ If you’re a Connecticut taxpayer wondering where your money’s...

Neil Caron

Aug 6, 20252 min read

🚫 Stop Calling It a Buyer’s Market — Connecticut, We’re Not There (Yet)

📅 August 4, 2025 | 🏡 Market Watch | Presented by ReadySetLoan™ 📣 Social feeds are buzzing with agents declaring “Buyer’s market!” —...

Neil Caron

Aug 4, 20253 min read

📍 Missed Payments, Rising Pressure: Where Homeowners Are Falling Behind

July 31, 2025 | Mortgage Insights | Presented by ReadySetLoan™ A new map from RealtyTrac and ATTOM reveals a concerning rise in mortgage...

Neil Caron

Jul 31, 20252 min read

Where Are the First-Time Homebuyers? A Generation Left on the Sidelines

July 30, 2025 | Market Insights | Presented by ReadySetLoan™ According to new analysis, first-time homebuyers in the U.S. are...

Neil Caron

Jul 30, 20252 min read

bottom of page